A Cost Benefit Analysis of the Carbon Tax: What Is It and What’s Its Purpose?

The carbon tax is a tax imposed by the government that requires carbon emitters (most often businesses) to pay a fee for each ton of carbon emissions they produce. This article will help you understand more about carbon taxes through a cost-benefit analysis of the carbon tax.

Table of Contents

What Is a Carbon Tax and How Does It Work?

What Is a Carbon Tax and How Does It Work?

What Is a Carbon Tax?

A carbon tax is a government-imposed tax that requires corporations to pay a charge for each ton of carbon emissions they produce. A carbon tax places a direct price on carbon (unlike the related cap-and-trade system, which creates a price for emissions). The goal of carbon taxes is to encourage companies to reduce their carbon emissions through financial incentives.

Fossil fuels and the resulting carbon emissions are damaging the environment, putting the world’s natural resources at risk, and accelerating global warming, which causes extreme natural disasters, such as typhoons, drought, flooding, and more.

The carbon tax is considered a “Pigouvian tax”, or a type of tax that taxes business actions that create an additional cost (in this case, environmental harm) to individuals or society as a whole. In the case of the carbon tax, the idea is that businesses help pay for the costs of climate change that they’re creating, which is causing damage to society.

The Carbon Tax Process

Carbon taxation begins with planning and decision-making. The government must first figure out how much a ton of carbon will cost. The government usually comes up with an estimate with the support of specialists and economists. This estimate is then used as the basis for the tax rate. Many governments aim to create a tax rate that will bring advantages to the climate and environment, but that is not so high that it has a large negative effect on the economy.

The government must also determine which corporations should be taxed and which should not. This is to ensure that the taxation will have minimal effects on the consumers that rely on the products of these corporations.

Once the carbon tax is implemented, carbon-emitting corporations are encouraged to cut their emissions and invest in carbon-free practices and renewable energy sources to avoid future charges (a tax) on their operations. The more carbon a company emits (sometimes above a certain threshold), the more tax they must pay.

After collection, the government must identify how to allocate the revenue from the carbon tax to projects that will benefit both the economy and the environment.

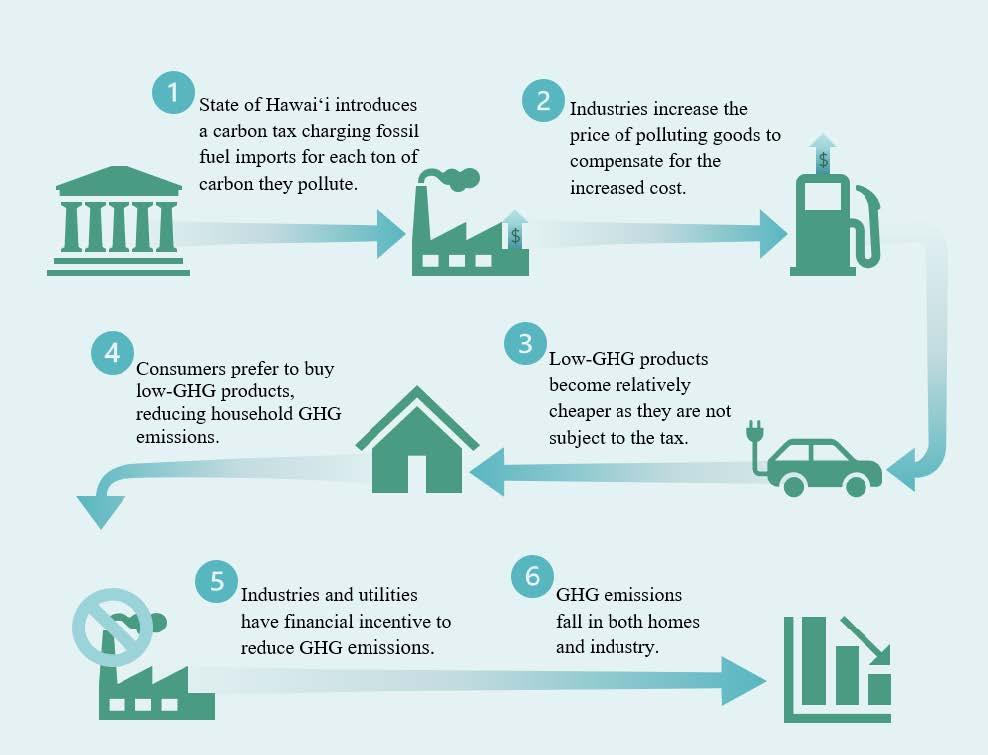

As an example of the carbon tax process, below is an infographic that illustrates how a carbon tax works in the state of Hawaii.

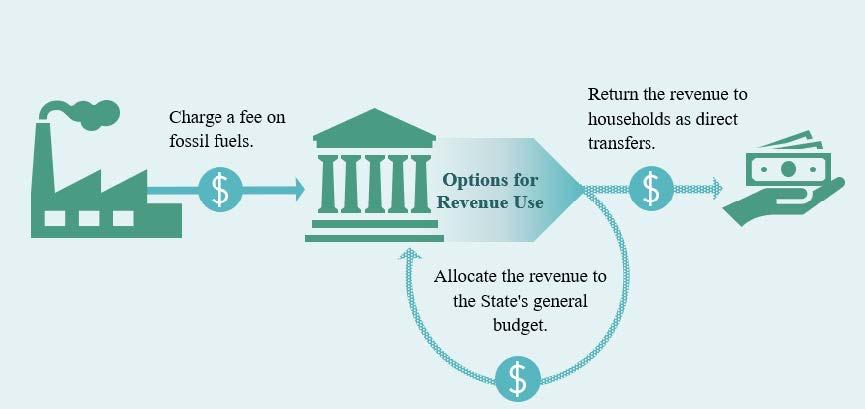

The infographic below shows an example scenario of a revenue recycling option in Hawaii’s carbon taxation plan. The revenue raised from carbon taxation is redistributed to different households in the Hawaiian community as cash support from the government. People can use this money as an additional budget to pay for their basic needs such as energy, food, and gasoline.

Purpose of Carbon Taxes

Why are carbon taxes implemented?

Carbon taxes are implemented to reflect the true costs of carbon. It’s a way to ensure that consumers and corporations pay for the environmental damages they create in society through their emissions.

The main goal of carbon taxes is to reduce carbon emissions by encouraging corporations to switch to renewable sources in order to avoid extra charges on their carbon-producing operations.

When was the carbon tax first implemented?

The first country to implement a carbon tax was Finland. As an initiative to accelerate climate change mitigation, in 1990, the country introduced a carbon tax that costs 1.41 USD per ton of carbon emitted.

In the U.S., the city of Boulder, Colorado was the first U.S. city to implement a carbon tax on consumers for their fossil fuel sources of electricity. The revenue from this tax is utilized to promote clean energy sources for electricity

Which countries have implemented carbon taxes?

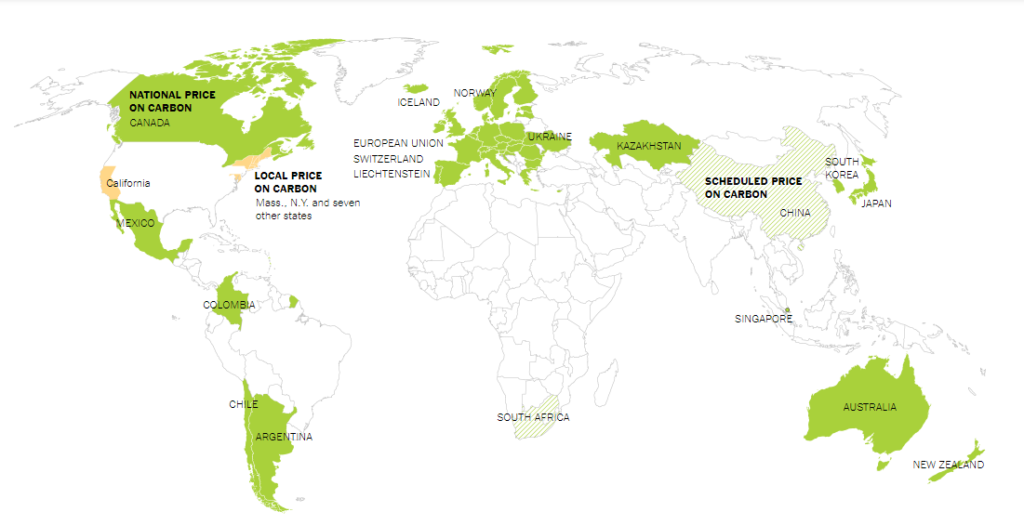

Several countries across the globe have implemented carbon taxes or are considering implementing them. This includes:

- Argentina

- Canada

- Chile

- China

- Colombia

- Denmark

- Italy (Considering implementing a tax)

- Japan

- Kazakhstan

- Korea

- Mexico

- New Zealand

- Norway

- Pakistan (Considering implementing a tax)

- Singapore

- Sweden

- Ukraine

- United Kingdom

- Vermont, United States

- South Africa

- European Union

Benefits of Carbon Taxes

The Benefits Of Carbon Taxes To the Economy And Environment

There are different benefits of a carbon tax for the economy. Here are a few economic advantages of the carbon tax:

The carbon tax increases government revenue.

Government revenue increases as corporations continue to pay taxes on their emissions. This increasing revenue from the carbon tax could be used to improve other social and environmental projects. For example, the total of collected revenue from carbon tax globally in 2016 reached over $28.3 billion. Clean and renewable energy investments have utilized 27% of all collected revenue, while the governments have used 26% of all collected revenue as funds, and the remaining 36% is used to increase different types of benefits for all taxpayers in communities.

The carbon tax charges major polluters for the damages they cause to the environment.

The carbon tax holds corporations who are major polluters accountable for the environmental damage they cause. Considered a Pigouvian tax, the government ensures that the harm that these pollutants create is taken into account. For example, if a carbon tax is implemented, corporations such as Chevron, Shell, and ExxonMobil will be held more accountable for their contributions to climate change, especially because they are among the top carbon emitters in the world.

The carbon tax promotes climate change mitigation.

Because the carbon tax imposes an additional charge on corporations that emit carbon, these companies are encouraged to invest in and switch to renewable and sustainable energy sources. This will result in a significant reduction in carbon emissions that will contribute to climate change mitigation. For example, some of the world’s biggest oil companies, such as British Petroleum and Royal Dutch Shell, are now making investments in renewable energy. Supporters of the carbon tax believe that implementing a tax now will help mitigate the worst of climate change before it’s too late.

Costs of Carbon Taxes

The Costs of Carbon Taxes to the Economy and the Environment

The carbon tax could affect economic growth and hurt the poor.

The carbon tax will raise the price of fossil fuels, and in turn, of production that relies on carbon emissions. Companies that are affected by the increased price of production may increase the cost of their products and services for consumers. These connected effects could harm low-income individuals by raising the prices of their daily commodities such as electricity, gasoline, and food.

The carbon tax could increase illegal business operations and decrease transparency.

Carbon taxes may push companies to conduct their carbon-emitting operations under the table or illegally in order to avoid an excessive charge for their emissions. Companies may become less transparent about their actual carbon emissions, which can lead to bigger climate and environmental problems.

The carbon tax could push corporations to operate businesses outside the country.

Carbon taxes may drive corporations to operate their business in other countries that do not require a carbon tax to avoid the charges for their emissions. This could lead to the exploitation of other countries’ natural resources and public health.

The Current State of Carbon Taxes

Carbon taxes have been implemented in an increasing number of countries around the world in the past two decades, with varying methodologies depending on the country. Some countries have imposed a nationwide carbon price, while others have imposed a local carbon price per city, and still, others have imposed carbon pricing on a scheduled basis.

A carbon tax has already been implemented in around 40 different countries and 20 different city-regions around the world, which helped regulate 50% of their total carbon emissions or 13% of the world’s carbon emissions per year. This percentage is expected to increase since more countries are considering implementing a carbon tax in the future.

Yellow = local price on carbon

Stripes = scheduled price on carbon

Source: The New York Times/World Bank

Read more: The Impact of a Carbon Tax on Small Business