The Carbon Tax in Vermont

The carbon tax is a tax imposed by the government that requires carbon emitters (most often businesses) to pay a fee for each ton of carbon emissions they produce. The state of Vermont (VT) has considered several carbon tax bills, several of which failed, and has passed a few initiatives that closely resemble a carbon tax. In this article, you will learn more about the carbon tax in Vermont, including its history and how it impacts businesses and communities in the state.

Table of Contents

Current State of the Carbon Tax in Vermont

The Impacts of Carbon Tax in Vermont

Current State of the Carbon Tax in Vermont

Vermont is one of the most rural states in the U.S., with one of the lowest carbon footprints. However, they still contribute to climate change, mainly through transportation and heating. Transportation is the largest contributor to carbon emissions in the state, likely because of how rural and car-dependent much of the state is. The second-largest source of greenhouse gas emissions in Vermont is primarily fuel used for heating and other building energy uses. This includes propane and natural gas used for heating buildings, water, and cooking. Heating and insulating buildings are also often referred to as “weatherization.”

In 2019, leaders from multiple sustainable business organizations in Vermont called for the implementation of a carbon tax to reduce these emissions. As a result of this push, the state introduced two carbon tax bills that ultimately did not pass. Here’s an overview of the bills:

- Bill H.477

This bill was introduced in 2019 by Representative Diana Gonzalez of Winooski, VT, a Progressive House member. The bill proposed a fee ranging from $5-$50 per ton of carbon emitted. The revenue from the tax would be reinvested in public transportation, weatherization, and as a tax credit for low-income Vermont residents.

- Bill H.463

This bill was introduced in 2019 by Progressive Representative Selene Colburn of Burlington, VT. It proposes implementing a price on carbon emitted from fossil fuels ranging from $5 to $40 per ton. The revenue from the tax would be refunded on Vermont citizens’ electricity bills.

While neither of these bills went beyond committee meetings in the House, they still represented a bold step towards a climate tax in Vermont and set a tone which helped Vermont pass its first carbon tax legislation.

Bill H.439: A Vermont Carbon Tax?

Vermont passed bill H.439 in 2019, which provides state-subsidized funding for low-income Vermont citizens to weatherize their homes. In summary, the bill imposes a tax on home-heating fuels containing carbon, and the revenue is used to help weatherize homes. Weatherization helps reduce carbon usage by making home heating more energy-efficient and less fuel-intensive.

Bill H.439 is funded through a tax on home-heating fuels that contain carbon, meaning that it is a tax on fuel usage in the same way a carbon tax is. Republican Representative Christopher Mattos proposed amending the bill to include language explicitly calling it a “fuel carbon tax.” However, others argued that it is not a carbon tax because it is a tax on gallons of fuel purchased, rather than the amount of carbon released when that fuel is burned.

Although perhaps not a carbon tax in the strictest sense, H.439 achieves a similar goal to Bill H.477: increased energy-efficient weatherization that results in reduced emissions from heating homes.

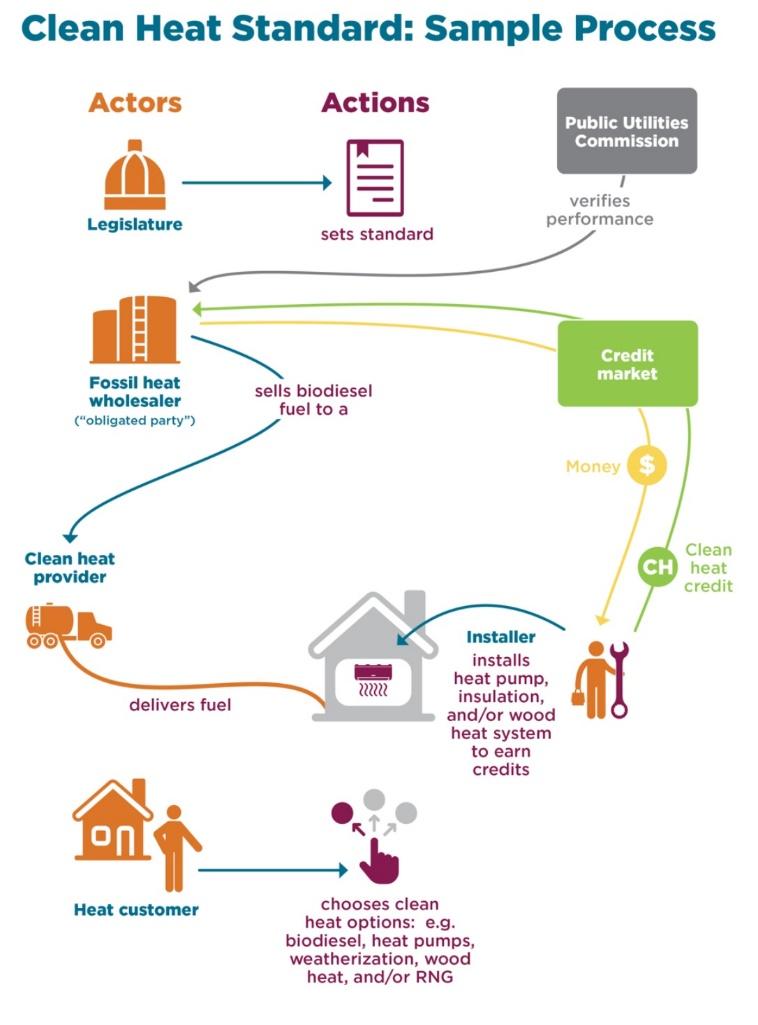

The Clean Heat Standard

In 2021, the Vermont Climate Council introduced an initial climate action plan proposing the implementation of the Clean Heat Standard (CHS). In the action plan, to reduce carbon emissions, fossil fuel companies in Vermont would have to meet a performance standard that fits the guidelines of the Global Warming Solutions Act. Even if it adds additional work and costs, fuel companies will have to provide heating fuels sourced from cleaner energy to support Vermonters to heat their homes more efficiently.

The goal of the Clean Heat Standard is to encourage fuel companies in Vermont to use cleaner fuels or switch to renewable energy sources that could make weatherization in the state cheaper and more energy-efficient. The standards would be applied to different major suppliers and wholesalers of heating fuels in the state. This would have a domino effect that could promote more low-carbon fuels and renewable energy sources for weatherization available in the market for Vermonters.

The pressure of the Clean Heat Standards raises the price of fossil fuels, but it could lower prices for cleaner energy by promoting low-carbon fuels and renewable energy sources in the market. Supporters of the Clean Heat Standard argue that it will aid moderate-income Vermonters and provide them with higher clean weatherization solutions in the beginning years of implementation.

On March 16, 2022, the Vermont House of Representatives approved Bill H.715, which aims to reduce the state’s greenhouse gas emissions by 80% by 2050 through the Clean Heat Standard.

Source: Energy Action Network

The Regional Greenhouse Gas Initiative: Cap and Invest Program

The Regional Greenhouse Gas Initiative (RGGI) is a cooperative program across the East Coast region that works to cap and reduce carbon emissions in the power sector. It is described as a “cap-and-invest regional initiative,” as eleven states, including Vermont, work together to establish a limit on emissions from power plants within the states.

Participating states include:

- Connecticut

- Delaware

- Maine

- Maryland

- Massachusetts

- New Hampshire

- New Jersey

- New York

- Rhode Island

- Vermont

- Virginia

Within the eleven states, power plants must buy an “RGGI allowance” for every ton of carbon dioxide they emit. These allowances are limited, so power plants must purchase them in auctions. This works to create a market-based price for carbon dioxide. This program not only increases power plant emissions transparency but encourages a move to forms of power that are not carbon-based.

Companies may also be eligible for carbon dioxide offset allowances if they undertake projects that reduce carbon or other greenhouse gas emissions. Like the regular carbon allowances, these offset allowances allow the company to emit a certain amount of carbon dioxide.

The Impacts of a Carbon Tax in Vermont

Impacts of a Carbon Tax On Businesses in Vermont

There are different impacts of a carbon tax on businesses in the state of Vermont. Here are some examples:

Businesses can save money by switching to low-carbon energy sources.

Based on the design of the Vermont carbon tax, the major purpose of the Clean Heat Standard is to encourage companies to use low-carbon energy sources. Around 8% of Vermont’s GDP is spent on importing petroleum products, so businesses in the state may save money by phasing out importation and switching to low-carbon energy sources. This might also help the state’s local economy.

More security for businesses against extreme climate events.

With the help of a carbon tax in Vermont, emission reductions could be accelerated, which would help mitigate climate change. This could provide a safer environment for businesses in the state, allowing them to thrive and be more profitable through different seasons and as climate change’s effects worsen.

Promoting more productive and healthier employees.

Reducing emissions with a carbon tax offers various health advantages. For example, a 2017 study of the Regional Greenhouse Gas Initiative indicated that carbon pricing reduced air pollution, which helps to minimize asthma-related disease in employees and saved about 400 missed workdays in Vermont. This affects the productivity of businesses in Vermont.

Impacts of a Carbon Tax On People in Vermont

A carbon tax would also impact the residents of Vermont. Here are some examples of how a carbon tax affects Vermonters:

Increased job opportunities

Over 17,000 workers in Vermont are employed in clean energy companies, and this sector of the economy in Vermont is growing at a fast pace, putting them in the lead for providing solar jobs per capita nationwide. According to a Department of Public Service study, a Vermont carbon tax could create between 2,260 to 6,400 new jobs.

Low-income residents might be hurt by the costly switch to renewable energy sources

Low-income Vermonters may not be able to afford to make the transition to renewable energy sources for necessities like home heating. According to a 2018 analysis, Vermonters may not be able to afford to invest in energy-efficient equipment like solar panels and electric cars, which are typically more expensive.

Key Takeaways

The implementation of a carbon tax in Vermont creates new opportunities and different impacts on the community and the state as a whole. Here are the key takeaways about the state of a carbon tax in Vermont and its potential impacts.

- Vermont has passed two bills that closely resemble carbon taxes and work to reduce emissions from heating in the state.

- Vermont is a member of the Regional Greenhouse Gas Initiative, which creates a “cap-and-invest” program for power plant carbon emissions.

- Vermont’s carbon taxes impact businesses and people in multiple ways, as it provides security against climate change but may increase costs.